Business Continuation

Business Continuation

Minimize the risk if death, disability or critical illness were to happen to a key person or shareholder of the business.

Who's this for?

- Key Person

- Shareholder

- Buy Sell Arrangement

- Business Loan/Overhead Risk

Benefits

- Retain Key Employees and Shareholders

- Minimize the impact on your business if key employees, shareholders or business owners were to become disabled, critically ill or die

- Retire or lower debts if key employees, shareholders or business owners were to become disabled, critically ill or die

Latest News

Self-employed: Government of Canada addresses CERB repayments for some ineligible self-employed recipients

Great news for some ineligible self-employed Canadians who received the Canada Emergency Response Benefit (CERB)

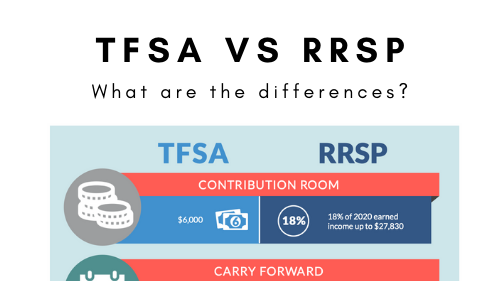

TFSA vs RRSP – What you need to know to make the most of them in 2021

Both TFSAs and RRSPs can be significant savings vehicles for your clients. We’ve put together an article to help your clients easily understand the differences between them – with one section focussing on differences in deposits and one focussing on differences in withdrawals.

The deposit section focuses on:

• How much contribution room is available each year

• How carry forward works for TFSAs and RRSPs

• Tax deductibility of contributions

• Tax treatment of growth

The withdrawal section focusses on:

• Conversion requirements

• Tax treatment of withdrawals

• Impact of withdrawals on government benefits

• Impact of withdrawals on contribution room

2021 Financial Calendar

We’ve put together a financial calendar for 2021. It contains all the dates you need to know to make the most of your government benefits and investment options. Whether you want to bookmark this or print it out and post it somewhere prominent, you’ll have everything you need to know in one place!