Mature Families

Mature Families

Who's this for?

- Age 45 to 54

- Established in career

- May have older children

- May be in peak earning years

Benefits

- Paying off mortgage

- Reduce all debts

- Saving for retirement

- Staying on budget

- Reducing income tax

- Taking care of the “What-ifs?”

- Disability

- Critical Illness

- Premature Death

- Make a will

- Consider powers of attorneys

Latest News

Why provide an employee benefits plan?

Business owners are increasingly recognizing the key importance of implementing employee benefit plans in their organization

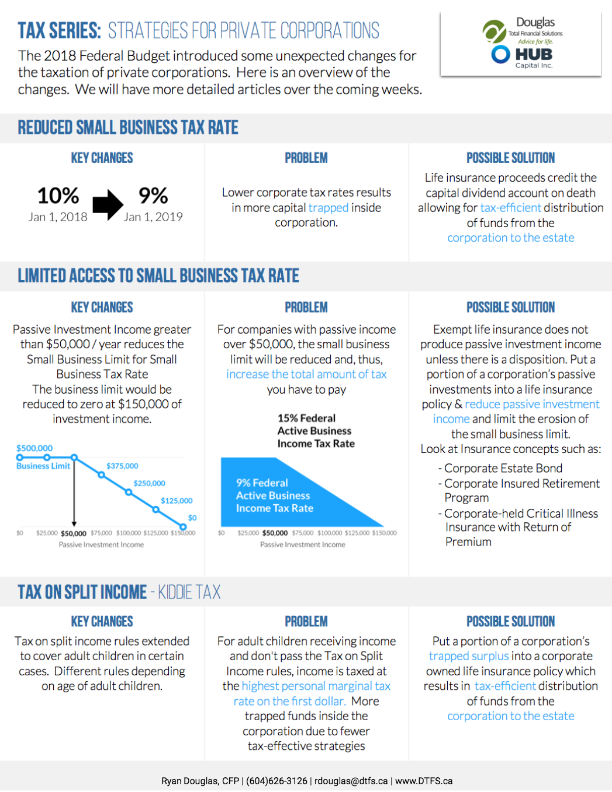

Passive Investment Income Limit

Morneau’s federal budget announced earlier this year informed us how the government will treat passive income in a Canadian Controlled Private Corporation. (CCPC) The government’s main concern was that under the current rules a “tax deferral advantage” exists since tax on active business income is usually lower than the top personal marginal tax rate. Therefore if the corporate funds were invested for a long period of time, shareholders might end up with more after-tax amount than if it was invested personally.

Tax Series: Strategies for Private Corporations

Last summer, Finance Minister Morneau announced a number of tax reforms for Small Business Owners, including the changes to income sprinkling, minimizing the incentives to keep passive investments and reducing the transfer of corporate surpluses to capital gains.