Starting your career

Starting Your Career

Who's this for?

- Age 21 to 34 Years Old

- Starting your career

- Finished school

Benefits

- Pay off debts, student loans, credit cards

- Establish an emergency fund

- Start a Budget

- Pay yourself first: start a regular savings plan

- Downpayment for a home

- Save for large purchases: such as car,

- Start saving for your retirement

- Review your benefits from work including your health and disability benefits

Latest News

Why provide an employee benefits plan?

Business owners are increasingly recognizing the key importance of implementing employee benefit plans in their organization

Passive Investment Income Limit

Morneau’s federal budget announced earlier this year informed us how the government will treat passive income in a Canadian Controlled Private Corporation. (CCPC) The government’s main concern was that under the current rules a “tax deferral advantage” exists since tax on active business income is usually lower than the top personal marginal tax rate. Therefore if the corporate funds were invested for a long period of time, shareholders might end up with more after-tax amount than if it was invested personally.

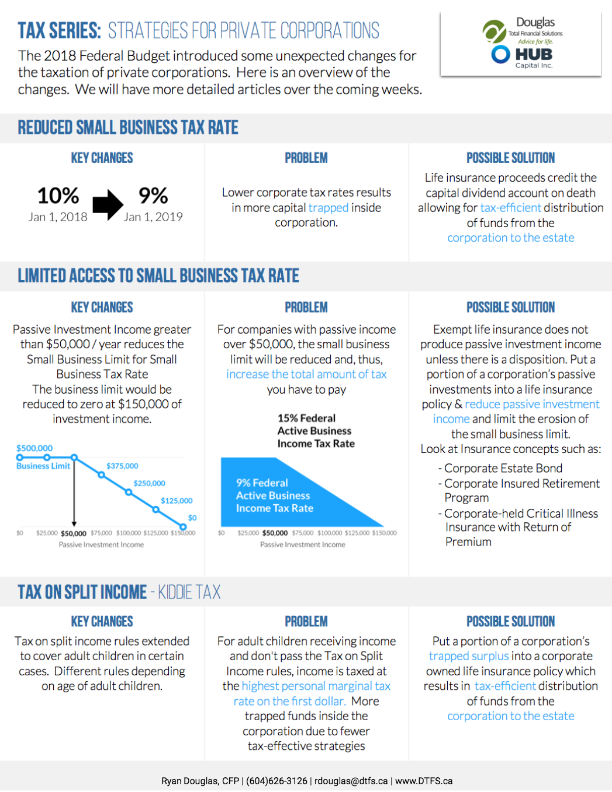

Tax Series: Strategies for Private Corporations

Last summer, Finance Minister Morneau announced a number of tax reforms for Small Business Owners, including the changes to income sprinkling, minimizing the incentives to keep passive investments and reducing the transfer of corporate surpluses to capital gains.