Blog

British Columbia 2021 Budget Highlights

On April 20, 2021, the B.C. Minister of Finance announced the 2021 budget. We have highlighted the most important things you need to know, including:

• Changes in the requirement to repay the B.C. Emergency Benefit for Workers

• Home Owner Grant threshold change

• PST exemption for electric bikes

• Elimination of PST rebate for certain vehicle sales

• Delay in the carbon tax increase

• Tobacco tax increases

• Changes to the speculation and vacancy tax

Federal Budget 2021 Highlights

On April 19, 2021, the Federal Government released their 2021 budget. Our article contains highlights of the various financial measures in this budget, divided into three different sections:

• Business Highlights, including an extension to COVID-19 Emergency Business Supports, new programs to support job creation, and a change in interest deductibility limits.

• Individual Highlights, including details on the tax treatment and repayment of personal COVID-19 benefits (such as CERB), eligibility changes to the Disability Tax Credit, an increase in OAS for those 75 and up, and support for job skills retraining.

• Additional Highlights, including a proposed federal minimum wage of $15, changes to the GST New Housing Rebate conditions, and new or increased taxes in areas such as luxury goods, tobacco, and Canadian housing owned by non-resident foreign owners.

What’s new for the 2021 tax-filing season?

Tax season is upon us once again. But since 2020 was a year like no other, the 2021 tax-filing season will also be different. Due to all the changes in both where and how Canadians worked, the Canadian government has introduced some new tax credits and deductions to keep pace with these changes. Our article covers all of the following:

• How to claim home office expenses

• The new Canada Training Credit

• Pandemic emergency funds

• New digital news subscription tax credit

Group Insurance vs Individual Life Insurance

While it’s great to have group coverage from your employer or association, in most cases, people don’t understand the that there are important differences when it comes to group life insurance vs. self owned life insurance.

Extended COVID-19 Federal Emergency Benefits

On Friday, February 19, 2021, Prime Minister Justin Trudeau announced an extension to:

– Canada Recovery Benefit

– Canada Recovery Caregiving Benefit

– Canada Recovery Sickness Benefit

– Employment Insurance

Self-employed: Government of Canada addresses CERB repayments for some ineligible self-employed recipients

Great news for some ineligible self-employed Canadians who received the Canada Emergency Response Benefit (CERB)

Self-employed: Government of Canada addresses CERB repayments for some ineligible self-employed recipients

Great news for some ineligible self-employed Canadians who received the Canada Emergency Response Benefit (CERB)

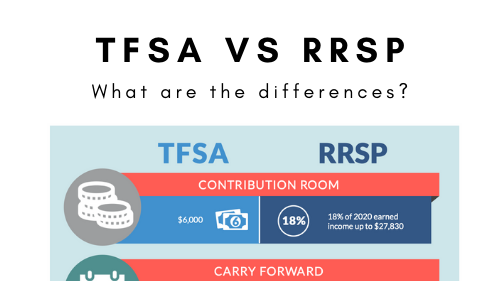

TFSA vs RRSP – What you need to know to make the most of them in 2021

Both TFSAs and RRSPs can be significant savings vehicles for your clients. We’ve put together an article to help your clients easily understand the differences between them – with one section focussing on differences in deposits and one focussing on differences in withdrawals.

The deposit section focuses on:

• How much contribution room is available each year

• How carry forward works for TFSAs and RRSPs

• Tax deductibility of contributions

• Tax treatment of growth

The withdrawal section focusses on:

• Conversion requirements

• Tax treatment of withdrawals

• Impact of withdrawals on government benefits

• Impact of withdrawals on contribution room

2021 Financial Calendar

We’ve put together a financial calendar for 2021. It contains all the dates you need to know to make the most of your government benefits and investment options. Whether you want to bookmark this or print it out and post it somewhere prominent, you’ll have everything you need to know in one place!

Government of Canada to allow up to $400 for home office expenses

For the 2020 tax year, the Government of Canada introduced a temporary flat rate method to allow Canadians working from home this year due to Covid-19 to claim expenses of up to $400.